These are all things to consider that type The premise in the proverbial “five-year rule” for selling a house.

Whenever you sell after below a year of proudly owning a home, your financial gain is a short-phrase cash acquire and it is taxed at everyday income prices.

Degree of the gain: If you owned and lived in the house for two from the earlier five years ahead of the sale, then as many as $250,000 of financial gain is often viewed as tax-cost-free.

People with the next cash flow are in an increased funds gains tax bracket than people with lessen incomes, just like with standard income taxes.

Maybe your economic circumstance has improved, and you’re no longer capable of keep up with the home loan repayments. Or even your house taxes have increased to the diploma that possessing the home is not financially beneficial.

Regardless of what you choose in the end, should you be considering selling your property after a year or significantly less of ownership, it is vital to have in touch with an experienced real-estate agent who may help tutorial you with the home selling process.

In Dallas, we acquire houses in all neighborhoods and in any condition. When you're employed with HomeGo, our knowledgeable agents are there with you all over the approach. Distinctive troubles? No challenge. Our agents contain the know-how and expertise to deal with all of it.

If you need out speedy, an even better thought could possibly be to lease the house. If you really are unable to stay clear of selling, selling that has a one% commission real estate agent may help you help save large on realtor expenses.

Having said that, Wiggs browse around these guys endorses examining with all your lender to find out when click here now you’re in the position to lease out your assets, as they sometimes foundation your bank loan on staying proprietor-occupied.

Sometimes you'll be able to’t keep away from selling a house shortly after getting. Here are some procedures to create the top of this kind of predicament:

You can avoid spending capital gains tax in a number of cases — which include task loss, divorce, Demise while in the household, and navy company.

Selling your house after a single year or considerably less normally is just not a very good economical final decision, but occasionally a fresh work or modify in money standing necessitates it.

Desire costs could be baffling, but you will find extra specifics of your loan payment terms within your house loan's amortization plan. Not sure where by to seek out this? Call your lender and they must manage to enable.

Remember find more to Notice: If you don’t meet up with these demands for that exemptions outlined higher than, the IRS has Particular principles that may assist you to declare a complete or partial exclusion.

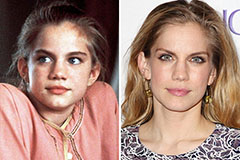

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Jenna Von Oy Then & Now!

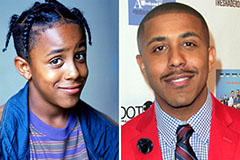

Jenna Von Oy Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now!